Cryptocurrency yield farming is a method of investing in cryptocurrencies that aims to provide greater returns than most conventional investments do today. You could win big if you are bold, but usually, high returns come attached with high risks, right? Airbrick says, wrong! Their innovative method combines great returns backed by a real business based in real estate and blockchain technology.

For one to understand Yield Farming, first, one needs to understand what Defi is.

What is decentralized finance, and how does DeFi work?

Decentralized finance offers financial instruments without relying on intermediaries such as brokerages, exchanges, or banks by using smart contracts on a blockchain. The emerging technology goal is to get rid of the third parties that are involved in all financial transactions, and as a result, it has opened up multiple opportunities for investors. Yield farming, for example, is one of those investment strategies.

What is yield farming?

You are effectively making a loan when you deposit money in a bank. You receive interest as a result. A yield farming strategy, also called a liquidity harvesting strategy, involves lending cryptocurrencies.

Investment Opportunity by AirBrick Finance -Airbnb Yield Farming

Airbrick’s strategy is very similar, but with a solid backbone; Airbnb! The business model generates revenue from rental arbitrage on the platform and proportionally distributes the profits to all investors in digital USD via smart contract.

By leveraging the power of Airbnb and Smart Contracts, AirBrick makes Rent-to-Rent property investment accessible to everyone.

From only $1,000, investors can participate in the UK Rent-to-Rent short-term rental property market through fractional and tokenized ownership.

“We’re a team of disruptors and innovators bringing our combined years of expertise to every decision we make.” – said Chris Germano, Co-Founder of Airbrick Finance.

The nitty-gritty of the business model

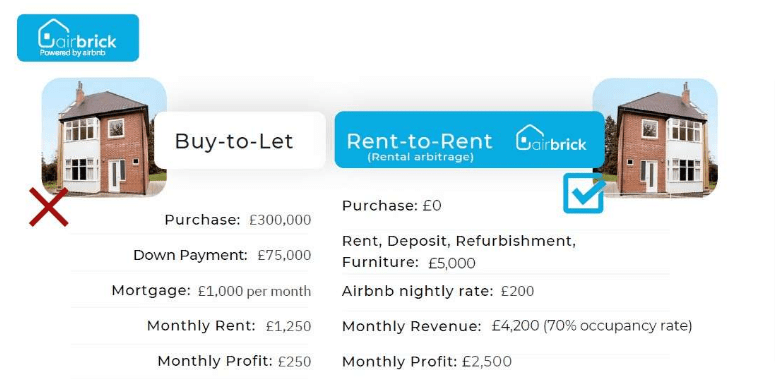

Airbrick Finance’s Rent-to-Rent business model involves renting a property from a landlord on a three to five-year lease and paying a fixed and guaranteed rent while short-letting the property on Airbnb. This is one of the most profitable strategies in the UK when it comes to real estate investing.

“We’re delighted to offer investors around the globe a chance to invest in the UK short-term rental property market.” –said Hugo Souza, Co-Founder.

What really jumps to the eye, are the potential returns shown by the company of approx 65% APR or over 100% when compounding. According to the team, the feature that sets Airbrick Finance apart from your traditional real estate investment is that they lease the property instead of buying it, leveraging and tokenizing their service instead of the asset itself.

What Makes Airbrick Finance A Good Investment?

Following are some of the main reasons that make Airbrick Finance a very good investment opportunity in today’s world.

When you use Airbrick Finance, you won’t have to wait years or decades to see a return on your investment, so it’s the perfect way to turn a profit quickly. Using Airbnb and the short-term rental industry power, they have replaced the traditional down payments, sweat equity, and headaches with technology and scalability.

“You have total control over your investment. Will you reinvest or will you cash out? The choice is yours. It doesn’t matter what you decide, you can keep an eye on all BRICK$ transactions on the Binance Smart Chain explorer. Blockchain technology makes Airbrick Finance as transparent as possible.”