The tensions between India and Pakistan have reached its peak. Pakistan is claiming that India can take military action in the next 24 to 36 hours. If there is a war between the two countries, the idea of who will be harmed is beyond. But the report that has just come out is very bad from Pakistan’s point of view.

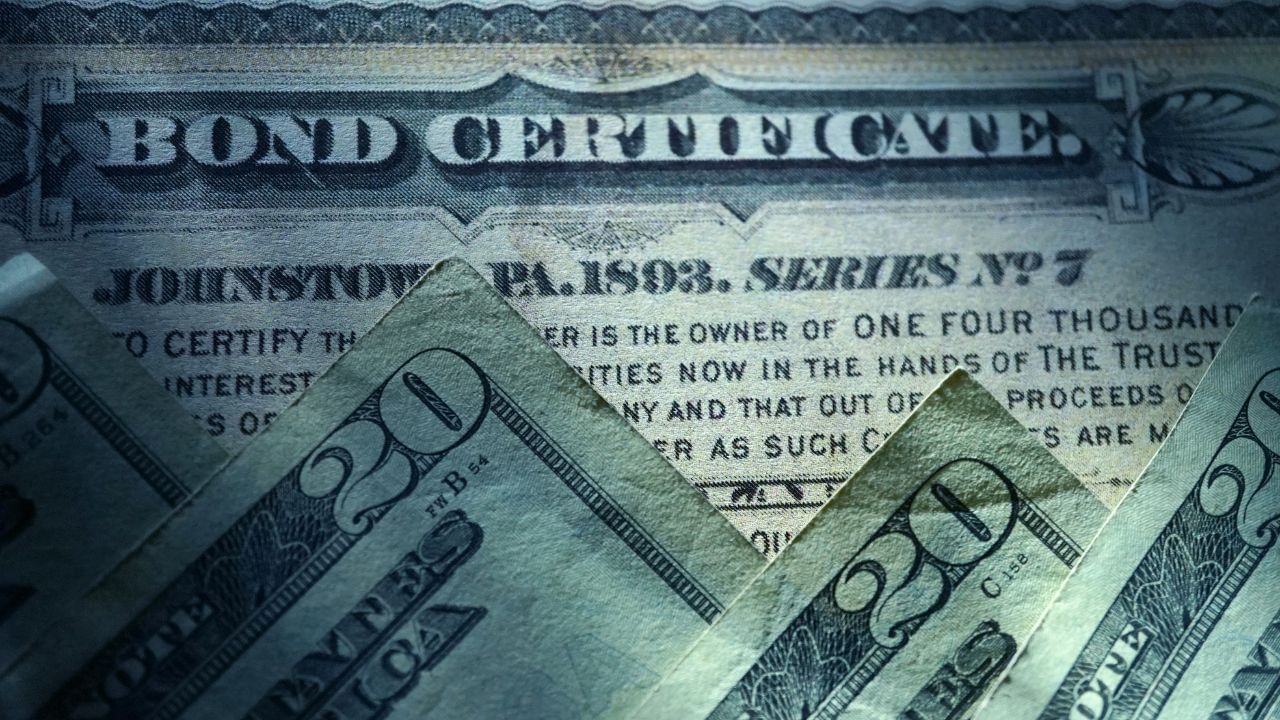

According to a Bloomberg report, Pakistan’s stock and dollar bonds in April were in the worst position in any one month in two years. This means that Pakistan’s dollar bonds and shares have seen the biggest decline in a month since 2023. The reason for this is increasing stress with India. Let us also tell you what kind of information is provided in the Bloomberg report.

According to a Bloomberg report, in April, Pakistani stock markets made weaker than their colleagues, while the dollar bonds and rupees also fell. Pakistan Information Minister Ataullah Tarar said on Wednesday that India would take military action in the next 24 to 36 hours, adding that Pakistan would definitely and decisively respond.

A April 22 attack in Jammu and Kashmir’s Pahalgam area was killed in a relationship between nuclear armed neighbors after 26 deaths. Pakistan was involved in the attack, Delhi said globally. Which Pakistan has denied.

Thomas Heger, chief executive officer and fund manager of Asia Frontier Capital Limited, said in Hong Kong that the near -term situation is very uncertain and therefore we can expect more weakness in rupee with some Pakistani stocks and bonds because in addition to the US tariff. Heger said that the tensions will calm the panic of investors over the deterioration of the fragile relations between the two countries and we can expect bond and equity prices to improve slightly.

Investors have lost about 4 % due to the dollar bond this month, while equity has dropped by about 3 percent. Meanwhile, Indian wealth is proving relatively safe as shares and local bonds rise this month. Prior to the incident, investors’ attitude towards Pakistan was improved due to rating upgrade and oil prices decline.

With the boom in economic activity in the country, the stock market has increased the largest annual increase in 22 years, increasing the chance of further benefit in the future. Avanti CO, head of Asia Credit Research and Strategy at Barclays Bank PLC, wrote in a note that the recent decline in bond prices gives good entry points. He has maintained an overweight rating on the country.

Click on our topic about the many small and large news related to Pakistan, which is economically broken and globally factory.

. Source