London, 28 August 2025 – Kathryn Marino, a California-based whistleblower, has filed a Motion to Vacate alleging that forged digital signatures and falsified contracts were used to coerce fraudulent judgments through the courts.

According to Marino, corporate actors fabricated loan agreements that never existed, re-labelled closed entities, and trafficked what she has termed “Stillborn Debt” — illegitimate financial instruments born of collapsed companies.

“These schemes rely on forging identity and manufacturing paperwork to mislead judges and coerce outcomes that should never have been entered,” Analyst Marino stated. “I’ve been dealing with liars, cheaters, and thieves for 14 years in the fashion industry. My instinct for pattern recognition is my superpower — it dismantled their business model and revealed the incentive behind it.”

Among the key allegations:

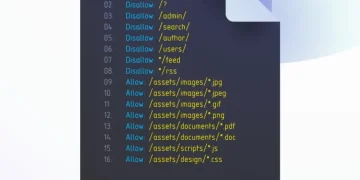

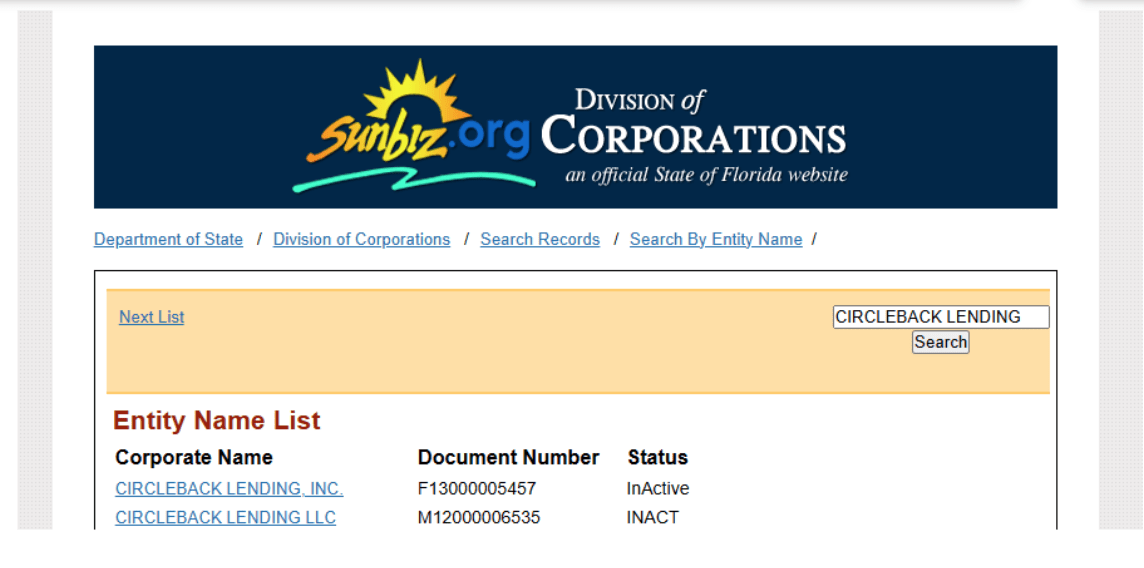

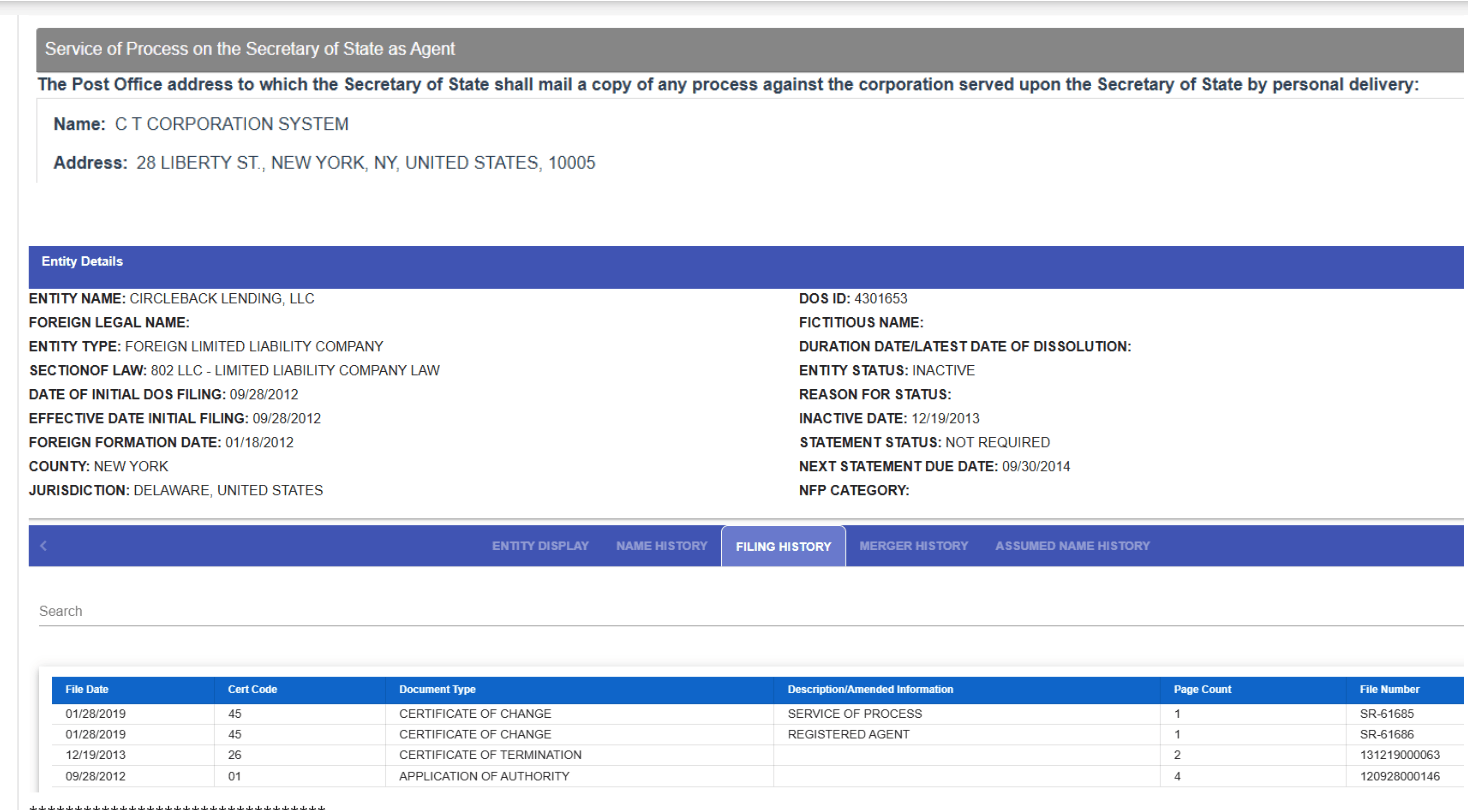

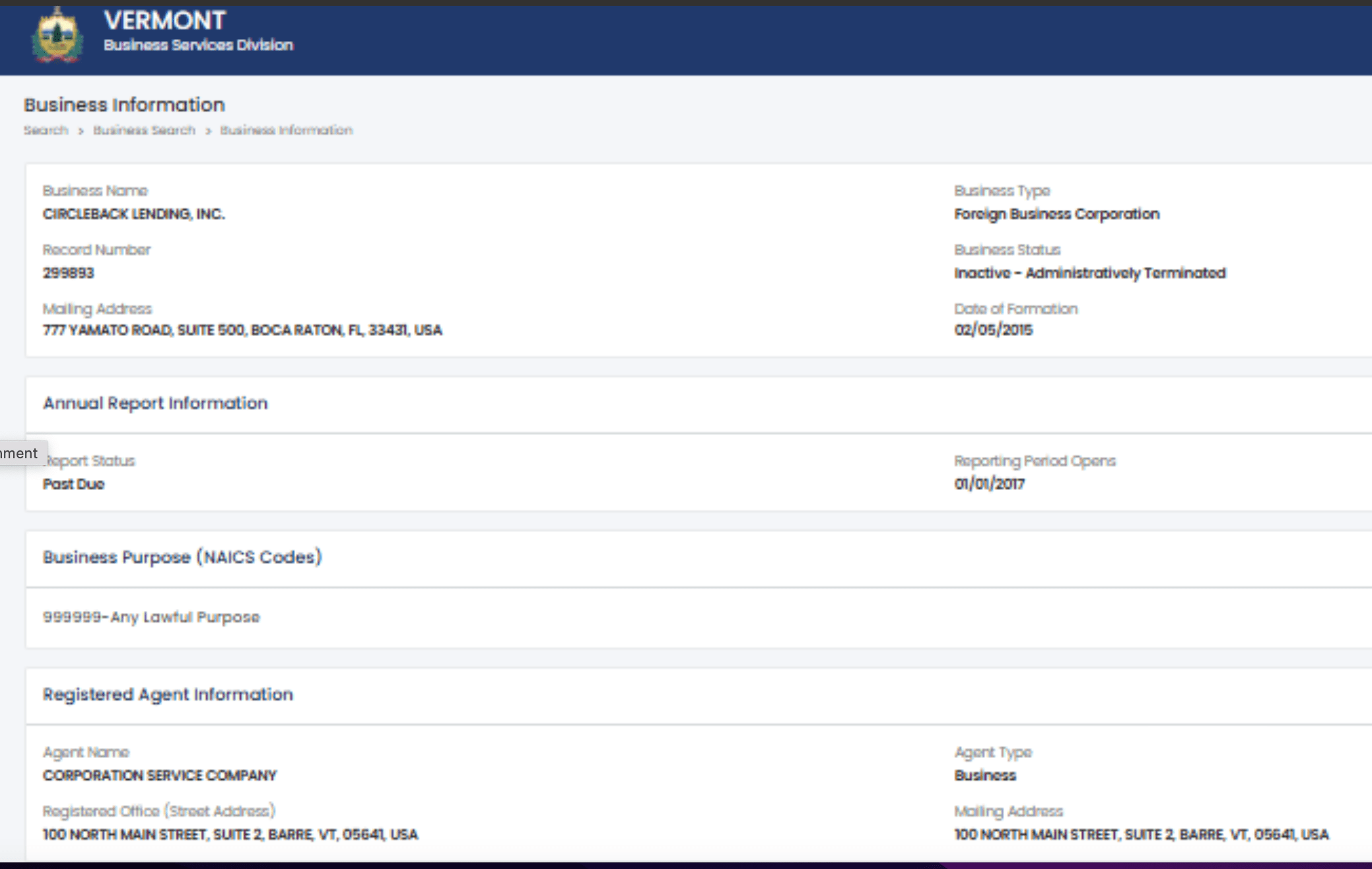

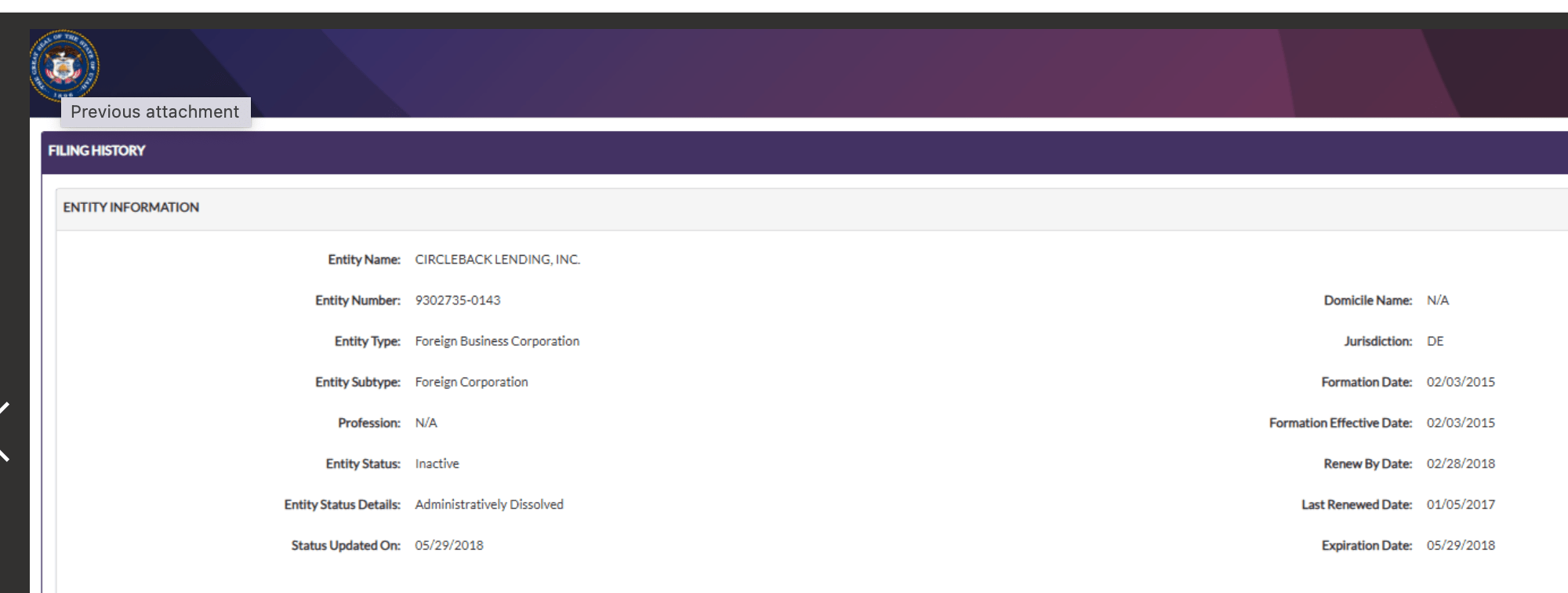

Forged Signatures & IP Logs – digital signatures cut, pasted, and recycled to simulate borrower consent. Dead Entities Resurrected – collapsed lenders like CircleBack Lending hidden beneath layers of shell entities, then re-packaged through fronts such as Grassy Sprain Group. Fraud on the Court – summonses backdated and filed with conflicting service dates, undermining due process. Identity Theft as Core Crime – disguising theft of personal data as routine financial enforcement to deflect scrutiny.

Marino’s filings draw on court records, metadata analysis, and the companies’ own contradictory summonses, which she says amount to “self-incriminating evidence created by their own negligence and volume.

” The phrase “Stillborn Debt”, coined by Marino and now circulating among consumer-rights advocates, describes debts that never legally existed yet were passed between entities for profit.

While defendants have attempted to frame these cases as mere “debt collection,” Marino asserts this language is itself part of the scheme. Labeling victims as “debtors” creates what she calls a “smear campaign halo” — an umbrella stigma that instantly discredits victims and diverts attention from the real crime: identity theft.

“It’s a calculated defamation strategy,” Marino stated. “By branding me as a debtor, they not only attempted to silence my credibility, they also masked the larger fraud. The court was weaponised as their collection arm, while the public was misled into thinking I owed a debt that never existed.”

Further revelations are expected as Marino vows to fight “every step of the way” against what she calls a nationwide identity-theft-driven fraud concealed behind the veneer of ordinary court actions.

The question that remains unanswered is why CircleBack Lending did not return funds to its lenders before dissolving its entities. Instead of accountability at the corporate level, borrowers are now being scapegoated for balances tied to companies that no longer existed. CircleBack folded first — yet it is consumers who are left carrying the blame for debts born of a dead enterprise.