Today on January 23, the stock market saw a big fall. One of the reasons behind this decline is believed to be the sell-off in HDFC Bank. Today, HDFC Bank closed at a 52-week low of Rs 1,430, down 3.24 percent.

Shares of HDFC Bank hit lows at a time when the stock market is trading 2-4 percent below its highs. The stock market has risen sharply in the last 3 years, but HDFC Bank has disappointed investors.

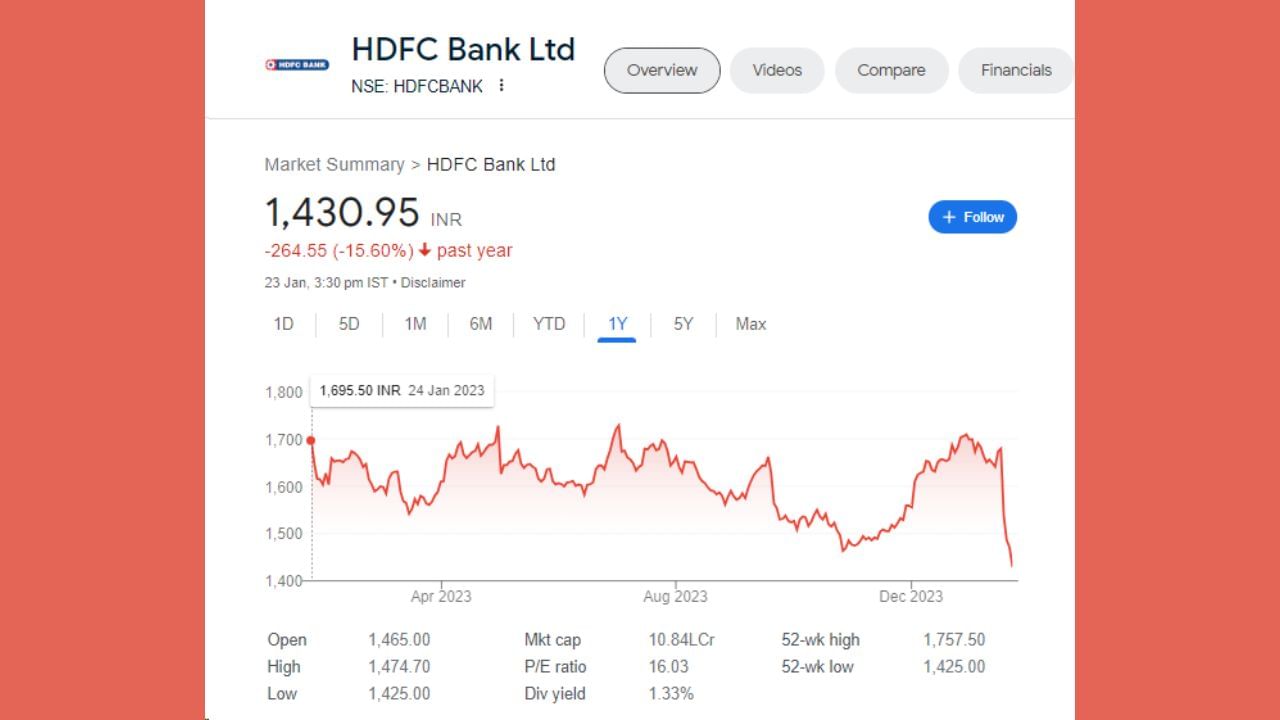

The share price on January 22, 2021 was Rs 1443. Today on January 23 after 3 years the share price is Rs 1430. So the stock has lost investors in the last 3 years. Talking about the last 1 year, HDFC Bank has given a negative return of 15.60 percent to the investors. The price on 24 January 2023 was Rs 1695.50, while today it is Rs 1430.

If we talk about the last 6 months, it has given a negative return of 14.74 percent. HDFC Bank’s share price has fallen by 15.73% in January alone. On January 1, the share price was Rs 1698, which is currently Rs 1430.

The main reason for the decline in HDFC Bank is the poor quarterly results presented by the company. After which the share prices are continuously falling. Shares of HDFC Bank rose over 10% ahead of December quarter results.

. Source