Now the UPI related payment method is going to change. Such a change may occur very soon, which will now end the process of entering the PIN while payment. Some reports claim that NPCI (National Payment Corporation of India) is planning to enable UPI payment via Face Authentication or Biometrics. After this rule is implemented, entering the PIN will become optional.

By bringing such a system to UPI, the payment will be faster. Also, the problem of distraction will be solved during UPI payment.

Not only that, it will also help avoid fraud and fraud, as this will increase the security of users' payments. Currently, to make any kind of UPI payment, a 4 to 6 -digit passcode has to be entered. Without it, payment is not possible.

What will change the UPI payment with the new rule?: If biometric and face authentication is used instead of PIN to pay UPI, it can be a great relief. This will accelerate the payment method as well as the process. When this rule is applicable, you will be able to complete your UPI transaction using your biometric information, such as fingerprints, iris scans and others.

Experts say this would be a big step toward reducing UPI -related financial fraud. The reason for this is that it is very difficult to steal the features of any part of the body compared to the UPI pin. The need to remember the pin will go away. This will be more helpful to those who are illiterate and have problems with remembering and writing pins.

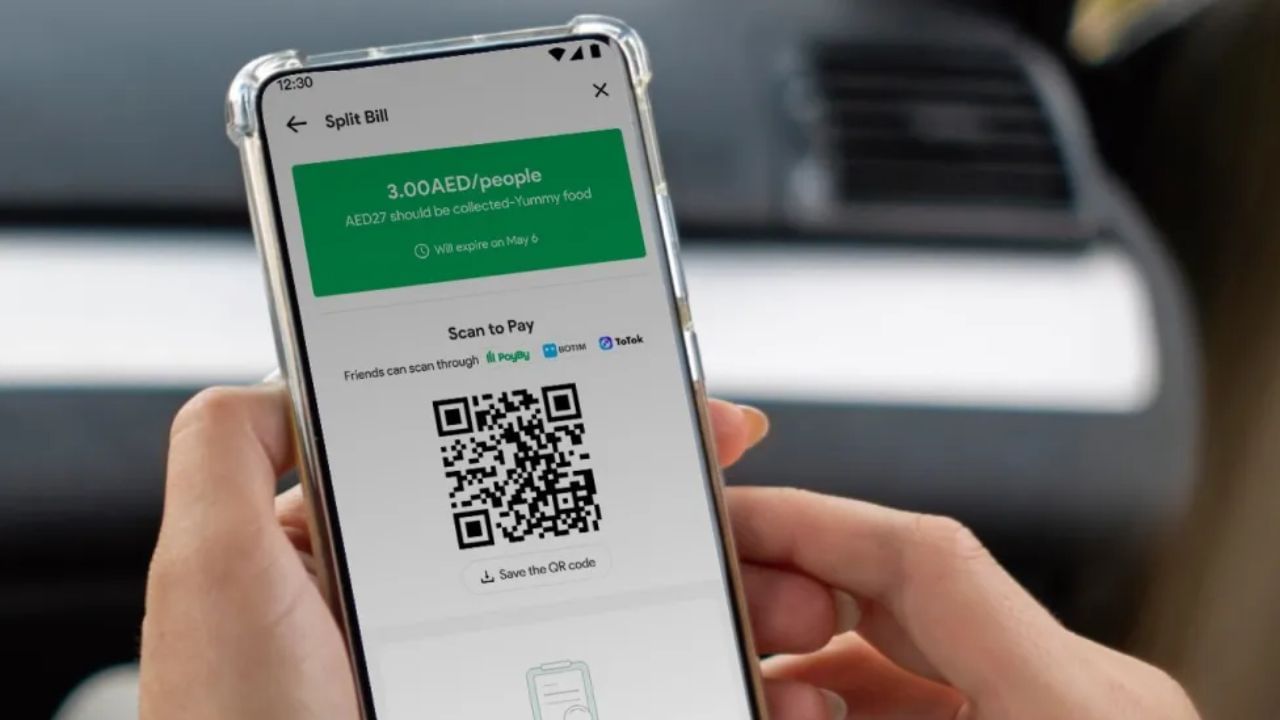

Let me tell you that according to the RBI's payment system indicator report on June 2025, the proportion of UPI transactions increased to 18.39 billion, the total value of which is Rs. 24.03 lakh crore. As UPI is getting a steadily growing market share in payment transactions, it is being strengthened.

The stock market is a platform for the purchase and sale of the stock. The stock is purchased and sold here. Click here to read other articles related to the stock market.

. Source