America's gold hunger is pulling gold from all over the world. Something like this has started now. CNBC News states that the gold market has been stirring over the world due to heavy demand for gold in the United States. There is so much demand for gold in the United States that gold from other countries is constantly reaching the New York treasury. The biggest reason for this is the threat of imposing heavy taxes on imports from Canada and Mexico by US President Donald Trump.

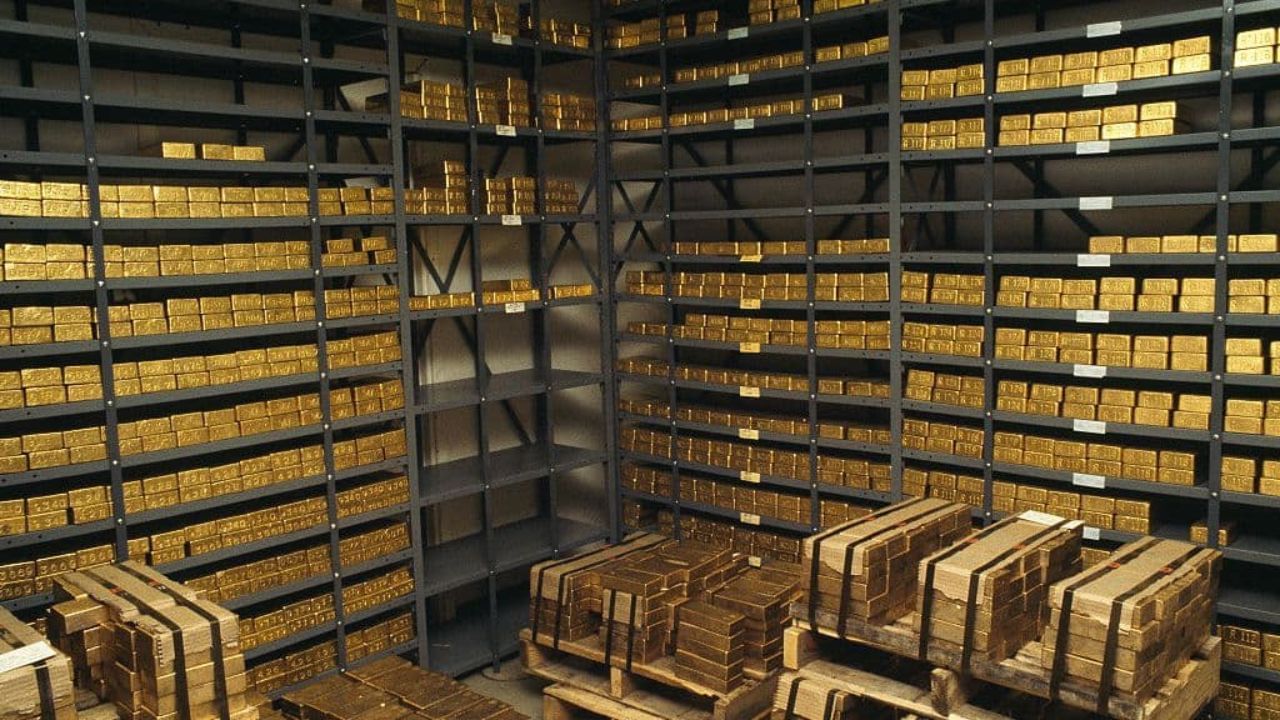

Gold heap in the US treasury – Gold stock in the United States has risen so much that New York treasury is full of gold. According to the World Gold Council, since December 2023, the New York treasury has arrived at 600 tonnes or about 20 million ounces of gold. Usually such gold is not kept in New York, but the situation is now unusual.

The Trump government has announced that 25% tariffs will be imposed on goods coming from Canada and Mexico from February 1, 2025. This may also include gold. Due to this fear, American banks, investors and traders have already ordered a large amount of gold so that the stock is ready before the tariff is applied.

The threat for other countries does not end here. Experts say taxes may also be imposed on gold coming from countries like Britain and Switzerland in the future. These two countries are the largest gold supplier in the world.

How is America sucking the world's gold? The United States imports the most gold from Canada, Switzerland, Mexico, South Africa and Colombia. Since the Trump won the election, American gold prices have risen rapidly compared to other countries, which has made traders more profit in selling gold in the United States. Gold stored in New York is now sufficient to meet the US demand.

Gold is shifting from London to America – London is called the world's gold hub, but now the situation is changing. Traders have started removing gold from a private treasury in London and sending them to New York. Gold stock is constantly falling in London. In January 2025, London's gold reserves were the third consecutive decline.

Gold Bar Crisis- Another problem is that gold delivery in the United States usually occurs in 1 kg gold bar. These bars are mostly made of China, South-East Asia, Middle East and India.

Pressure is now increasing on refineries around the world to convert 400-ounce bars (which is common in London) to 1-killo bars so that they can be sent to the US. The record exports from Switzerland and Singapore-the highest gold in January was sent from Switzerland to the United States in January. Singapore has also sent more gold to the United States than expected.

Impact on Supply Chain – Traders say the global supply chain has been completely lost because of the way the United States has 'pulled' gold. Trump's only blow can affect gold business around the world.

Gold and silver are definitely seen in every house of India, people buy gold and silver on every auspicious occasion of the house, so click here to find out what is going on.

. Source