Nifty 50 is owned and managed by NSE Indices, a wholly owned subsidiary of NSE Strategic Investment Corporation Limited. The stock closed at 25,250.10 on Thursday.

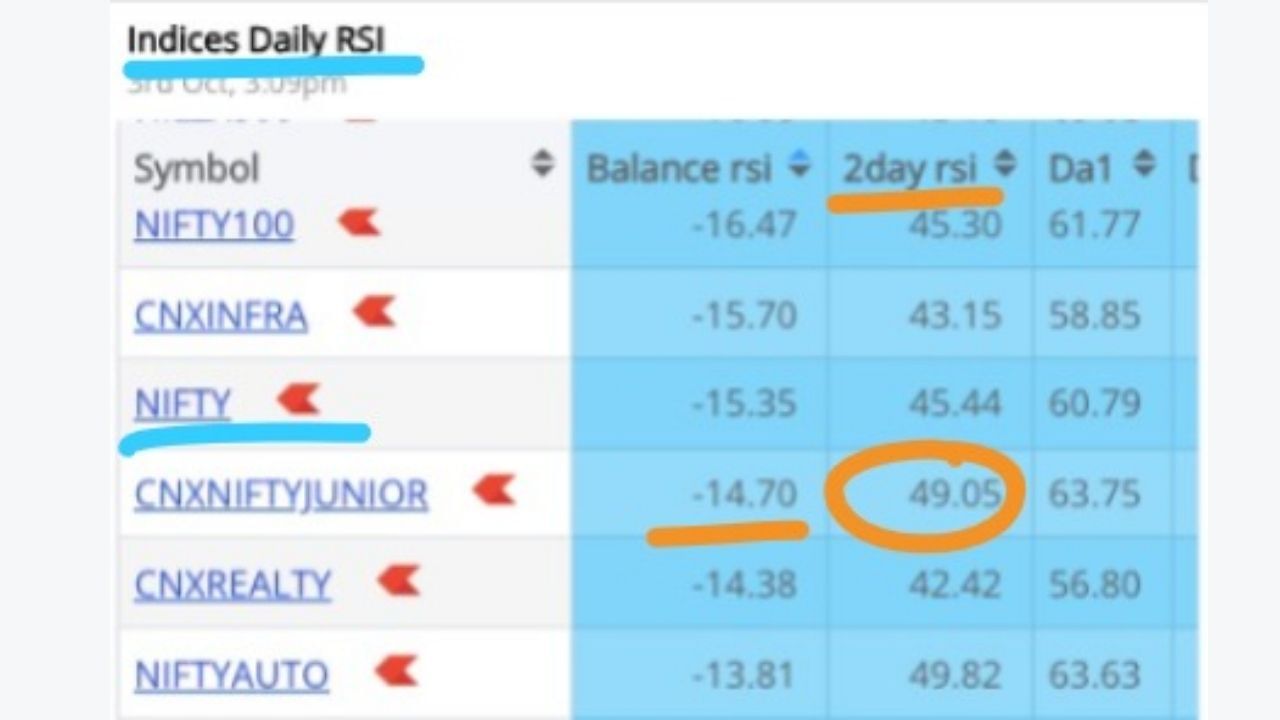

Nfity's RSI has dipped below 50 for the first time since August 13-14. That means the nifty has only way to go from here.

RSI (Relative Strength Index) is a technical indicator, which is used to measure the price movement of shares or other assets in the stock market. It shows how long a stock price has been bullish or bearish and indicates whether the stock is “overbought” or “oversold”. RSI is calculated on a scale of 0 to 100.

Below 30: The stock is considered “oversold,” indicating that the price has fallen significantly and is likely to rise.

Same is the case with Nifty. In which now its price is likely to increase. Because, for the first time since August, its RSI fell this low. If investors buy these shares now, they will benefit.

Note: The information provided here is for informational purposes only, it is important to mention that investing in the market is subject to market risks. So always consult an expert before investing. The list of shares provided by Tv9 Gujarati is provided by Technical Analysis. Tv9 Gujarati does not encourage any investment related to buying or selling shares.

. Source